2023 marked a significant chapter in real estate history, on the state level in Maine as well as nationally. If we were to pinpoint the standout factor, it would be the remarkably low number of homes listed, the lowest in over two decades. This scarcity in inventory had the effect of keeping prices high, but there was a substantial decrease in sales, approximately 19%, leaving prospective buyers eager. The attempt to restore equilibrium in interest rates, following their drastic drop in 2020, brought about by pandemic-induced rates, resulted in a sustained presence of higher monthly mortgage payments.

2023 marked a significant chapter in real estate history, on the state level in Maine as well as nationally. If we were to pinpoint the standout factor, it would be the remarkably low number of homes listed, the lowest in over two decades. This scarcity in inventory had the effect of keeping prices high, but there was a substantial decrease in sales, approximately 19%, leaving prospective buyers eager. The attempt to restore equilibrium in interest rates, following their drastic drop in 2020, brought about by pandemic-induced rates, resulted in a sustained presence of higher monthly mortgage payments.

Sales have been adjusting down from the 2021 frenzy for the past few years and when that began, concerns arose that it might be an ominous sign signaling an imminent market crash—a notion Anthony consistently disproved. Fast forward a year, and the anticipated crash hasn’t materialized. This resilience is more attributable to the reduction in inventory rather than a decline in sales. The dip in sales in 2022 wasn’t much of a surprise; rather, it was a welcomed relief. The frenzied market of 2021 was unsustainable, and consumers and REALTORS® alike hoped for a return to normalcy. The slower market activity in the subsequent year reflects the journey back to equilibrium. However, regardless of the necessity of a market adjustment, the process can be painful, and 2023 was certainly uncomfortable.

This report analyzes the sales figures, average prices, the number of active listings, and listings under contract for both 2023 and 2022. Furthermore, it delves into predictions for the real estate landscape in 2024.

2023 Real Estate Performance Highlights

- The number of homes sold decreased by 18.9%

- Average prices for closed sales increased by 10%

- Lowest number of homes listed in over two decades, decreased by 12%

- The number of homes placed under contract (pending) decreased by 16.4%

- Low inventory has boosted prices due to demand, still outpacing such low supply

- In conclusion… 2024 is predicted to be slightly better.

Maine Sales Decreased by 18.9%

In Maine, sales dropped from 20,258 in 2022 to 16,435 by the close of 2023, marking a decrease of 3,823 sales year over year. This decline can be attributed partly to buyers grappling with the affordability challenge posed by higher interest rates and continually escalating prices. However, a significant portion of the decrease is also linked to the persistently low inventory levels due to a lack of sellers.

Sales were down in all three categories:

- Single family sales down by 18.8%: 13,767 in 2023 from 16,959 in 2022

- Condo sales down by 9.8%: 1,725 in 2023 from 1,912 in 2022

- Multi-family sales down by 32%: 943 in 2023 from 1,387 in 2022

Below is a bar graph that illustrates the number of homes sold per year in Maine. You’ll see that 2023 was the lowest number of home sales since 2014 and that sales have declined significantly over the past two years.

You’ll see below that 2023 monthly sales were down year over year every month in 2023, not just over 2022 but over the past four years.

Average Prices Increase 10%

The average home price in 2023 saw a rise of $41,820 compared to 2022, reaching $462,012 as opposed to $420,192 the previous year. Despite the affordability challenges, prices continue to climb due to the ongoing scarcity of inventory. With motivated buyers contending with multiple offers, sales prices are being driven upward.

Prices increased in all three categories:

- Single family prices increased by 9.7%: $460,960 in 2023 from $420,304 in 2022

- Condo prices increased by 14.3%: $479,755 in 2023 from $419,730 in 2022

- Multi-family prices increased by 6.1%: $444,918 in 2023 from $419,461 in 2022

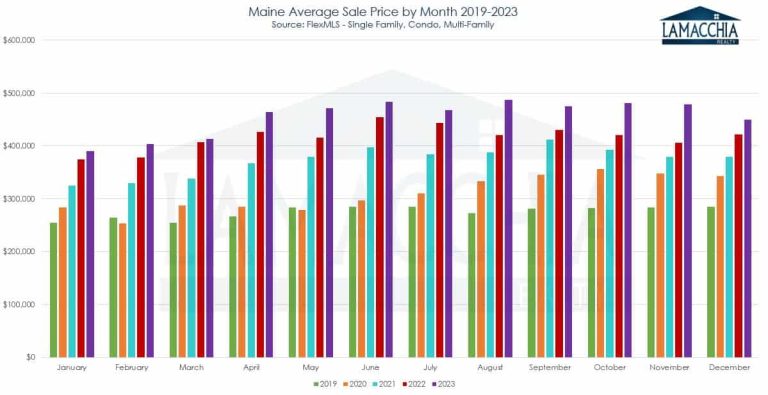

The bar chart illustrates that 2023 recorded the highest average prices since 2000, marking an all-time high. Despite affordability challenges with prices rising and higher rates, prices continue to rise at a high pace with little indication of a slowdown.

Monthly, Maine average sales prices were up over the four previous years in all of 2023.

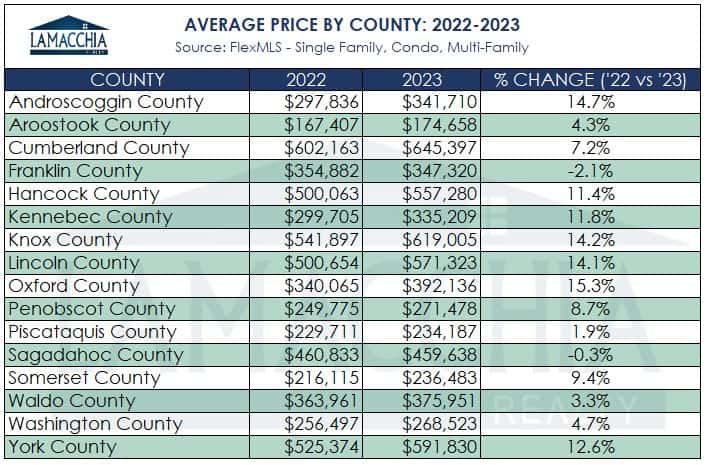

Price increases by county ranges from a 2.1% decrease to a 15.3% increase. Prices mostly rising all over the state indicated that buyers are moving to geographically more affordable areas and still paying more to secure the homes they want.

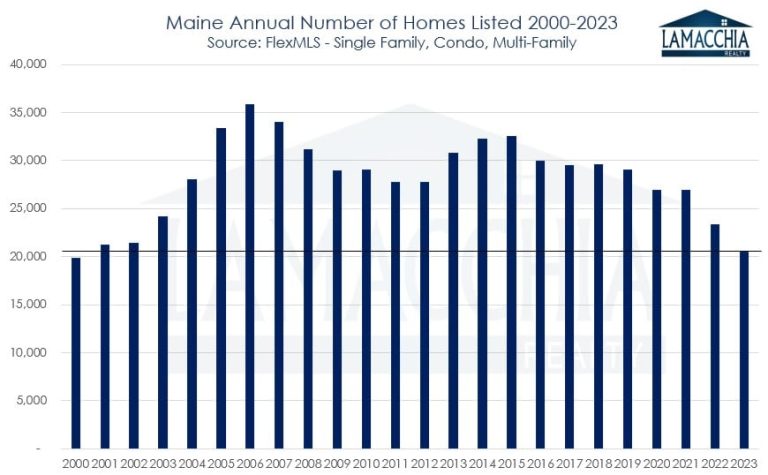

2023 Sees the Lowest Number of Homes Listed in Twenty-Two Years

In 2023, there was a 12% decrease in listings compared to 2022, with 20,546 homes listed compared to 23,342 in the previous year. Sellers are hesitant to put their homes on the market because they are reluctant to give up their pandemic-era interest rates, contributing to the lowest number of new listings since 2001.

Contrary to popular belief, interest rates don’t just impact buyers, they impact sellers as well, as demonstrated in 2023. Sellers are not only reluctant to move due to their desire to retain their current interest rates but also because they are concerned about potentially higher monthly payments if they need to purchase again. The scarcity of listings significantly contributes to the low inventory levels, leading to continued competition among buyers and thereby preventing price decreases. A significant increase in inventory would be necessary to warrant concerns (or hopes) of price declines.

In contrast to the current market dynamics, the bar chart below illustrates how the period from 2003 to 2006 experienced a substantial increase in the number of homes listed, resulting in an oversupply when demand was low, ultimately leading to the housing crisis. The current situation is the opposite, with low inventory levels and sustained demand.

Pending Sales Decreased by 16.4%

2023 concluded with the fewest pending sales since 2013. Unlike previous instances, this decline is not due to a lack of demand but rather a shortage of supply. In 2023, there were 16,348 homes placed under contract, representing a decrease of 16.4% compared to 2022, which saw 19,549 pending sales. The simple reality remains; you cannot purchase what is not on the market.

Maine Housing Inventory is Still Quite Low

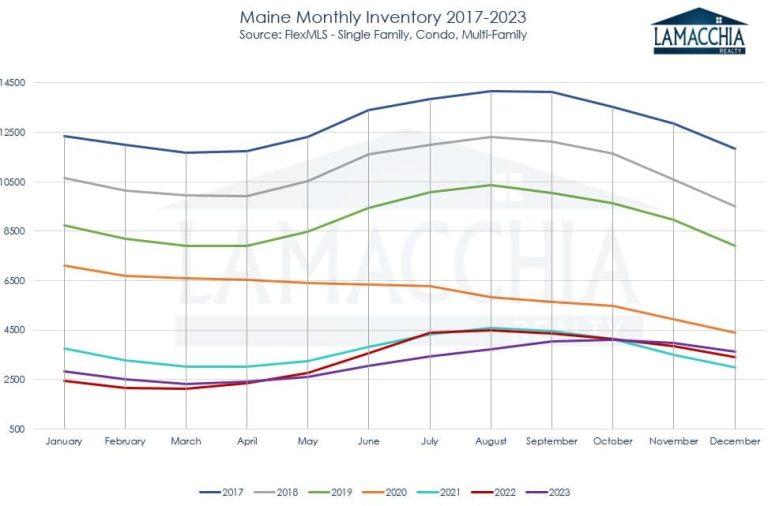

Listings are indeed down, and so are pending and closed sales. If sellers begin listing their properties at a faster rate while pending and closed sales continue to decline, inventory levels will continue to rise, potentially exerting downward pressure on prices. However, unless this scenario unfolds, prices are likely to remain stable, with demand continuing to outstrip supply.

In the line graph below, 2023 is represented by the purple line, which generally trends similarly to both 2022 and 2021. The beginning of 2022 marked the period of lowest inventory levels in at least the past eight years. It’s probable that we wouldn’t have witnessed the subsequent increase in inventory if not for the uptick in mortgage rates. The rise in rates, coupled with inflation, constrained buyer spending and prompted a slight uptick in inventory levels. Nonetheless, we are still far from pre-pandemic inventory levels because many sellers remain hesitant to list their homes for sale.

Will the 2024 Real Estate Market Improve?

The paradox of how mortgage rates affected both buyers and sellers created frustration in the 2023 market. While higher rates stalled both buyers and sellers, they also tempered frenzied buyer activity, allowing inventory to rise. However, sellers are listing their properties less than ever because they are hesitant to trade in lower rates for higher ones.

The theme of 2021 was buyer demand, 2022 saw rapid increases in mortgage rates, and 2023 was characterized by a lack of inventory and decreased affordability. Only highly motivated buyers and sellers, particularly those experiencing life changes like divorce or relocation, participated in the 2023 market.

Looking ahead to 2024, we anticipate a theme of easing pressure. In Anthony’s 2024 Predictions, he stated that “the worst is behind us, but we are not out of the woods.” While the market may remain slow, sales are expected to increase if rates trend down and stay low. This should motivate more sellers to list their properties, leading to a rise in inventory and potentially slowing down the pace of price increases or even causing prices to decrease slightly.

Buyers will likely benefit from lower rates compared to 2023, and mortgage programs such as buydowns and mortgage assumptions can further help in securing lower rates. Sellers, on the other hand, should take advantage of the lower inventory while demand remains high to maximize their sales. Even if rates settle in the 6% range, historically, this is considered very moderate.